When a microfinance institution does retail banking, it breaks all transactional barriers

Ujjivan Financial Services was one of the chosen 10 organisations to receive the Small Finance Banking license from the Reserve Bank of India. Built on the culture of group micro-financing in rural areas, Ujjivan has a strong, closely knit team that knowns the customer like family.

As it turned from a pure lender to a bank, the real estate had to not only look better but service the old and new customers in a unique way that was proprietary Ujjivan. There was a unique challenge there: a microfinance institution spends a whole lot of time communicating whereas the bank makes it pure transactional. How do you design a space that takes care of both? How do you make a bank branch that takes care of big crowds that gather on paydays without changing the layouts much?

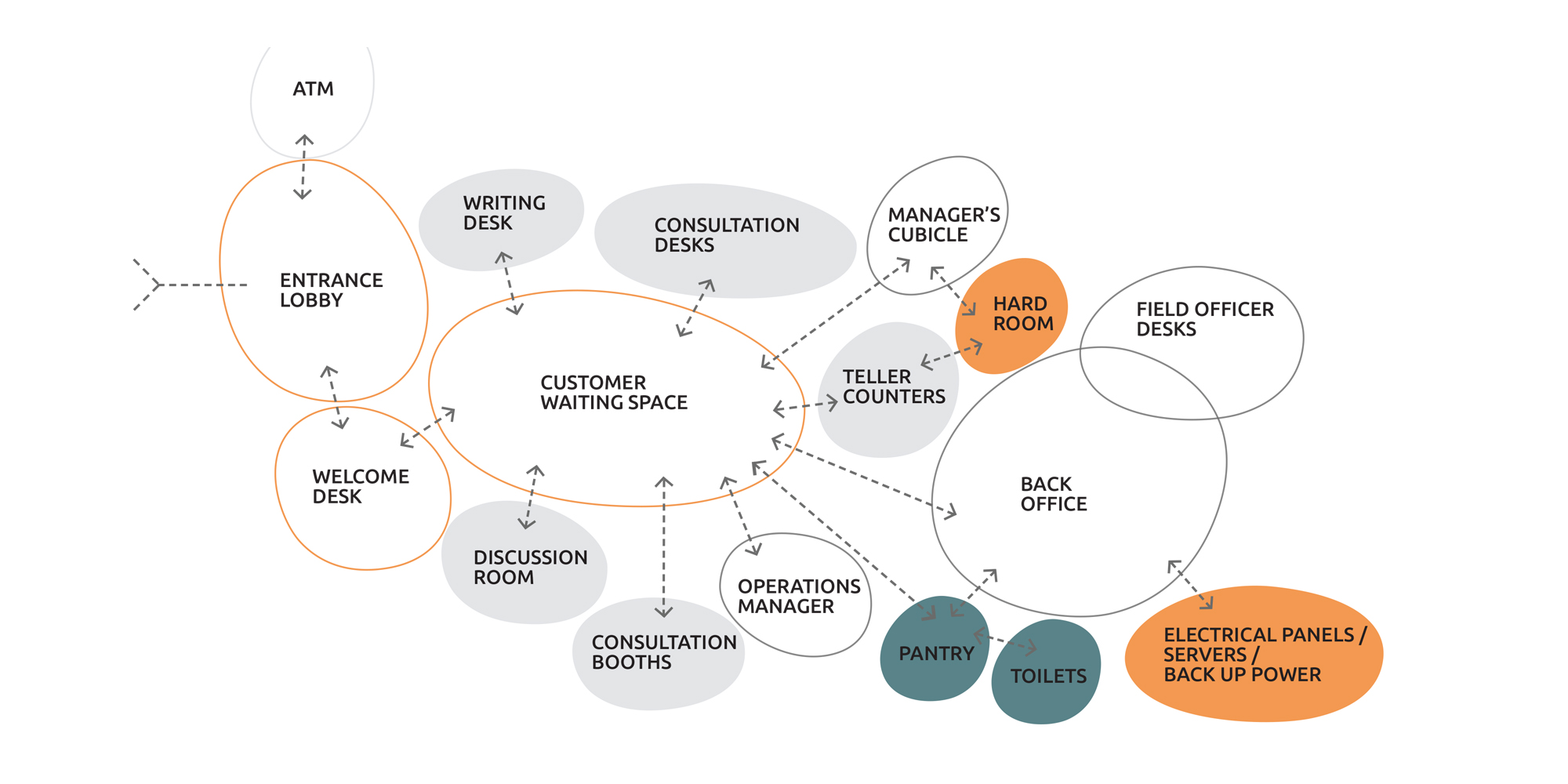

Our deep dive resulted into identifying key areas that would help us address this challenge. We came up with hyper-modular, hyper-flexible modules that can form the basic building blocks for each function within the bank branch. Three to four different types of branches were defined in terms of overall specifications, carpet area and number of employees in the branch.

The modules can now easily fit into any retail area as a seamless system. The layouts and the internal elements facilitate discussion and help when important but also gives a quick runway to cash counters bringing in efficiency to pure transactions.

The Ujjivan bank branches are live and the experience is deeply rooted in Ujjivan core values of empathy, of communication and of connectedness for social good.